Flexible retirement

If you like the idea of taking your pension while reducing your working hours, you may be interested in flexible retirement.

What is flexible retirement?

It’s a way of gradually moving into retirement, which allows you to access your pension benefits, while you continue to work – but your employer must agree to it first.

You can carry on paying into your local government pension (LGPS) and build up further benefits for when you fully retire.

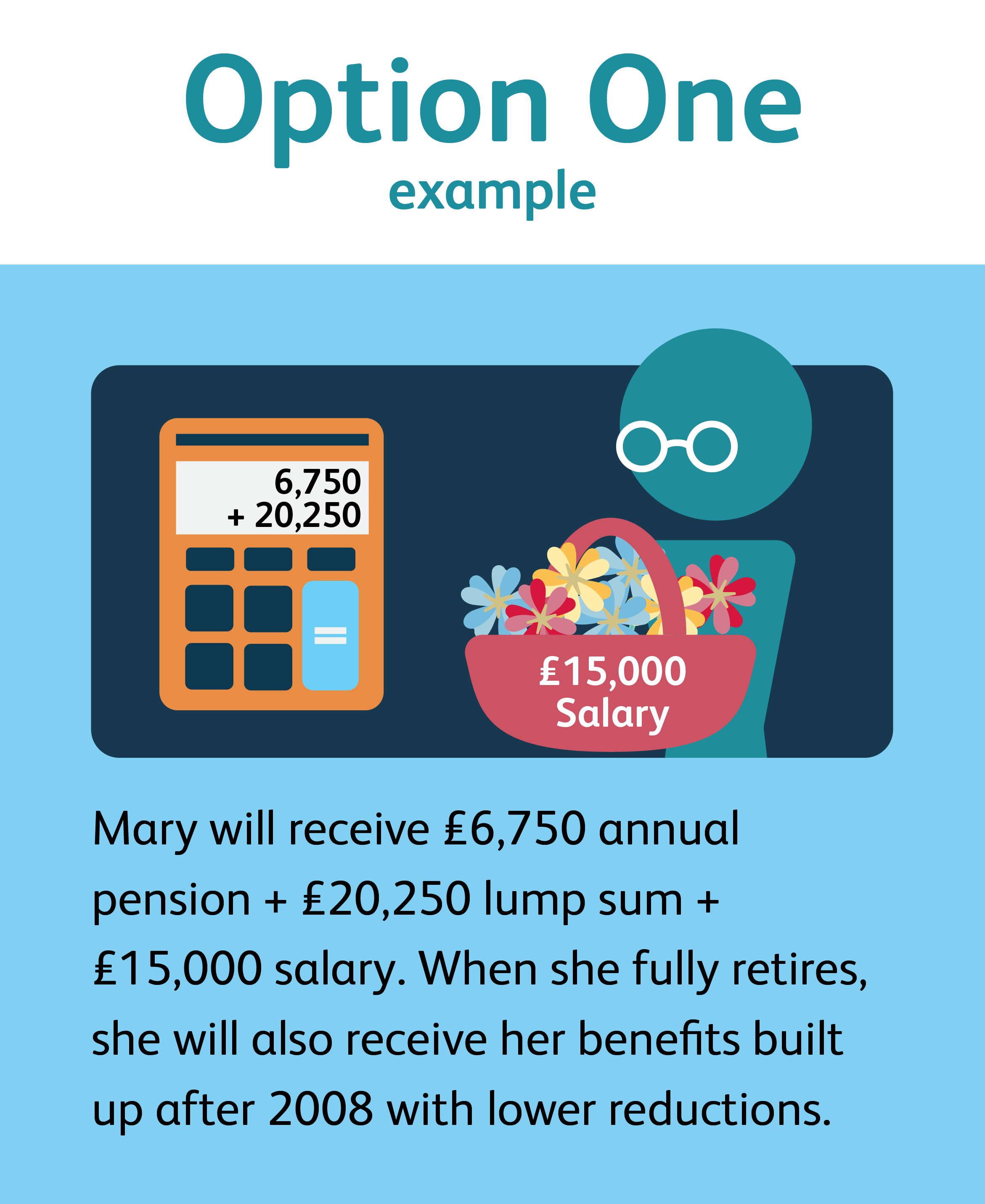

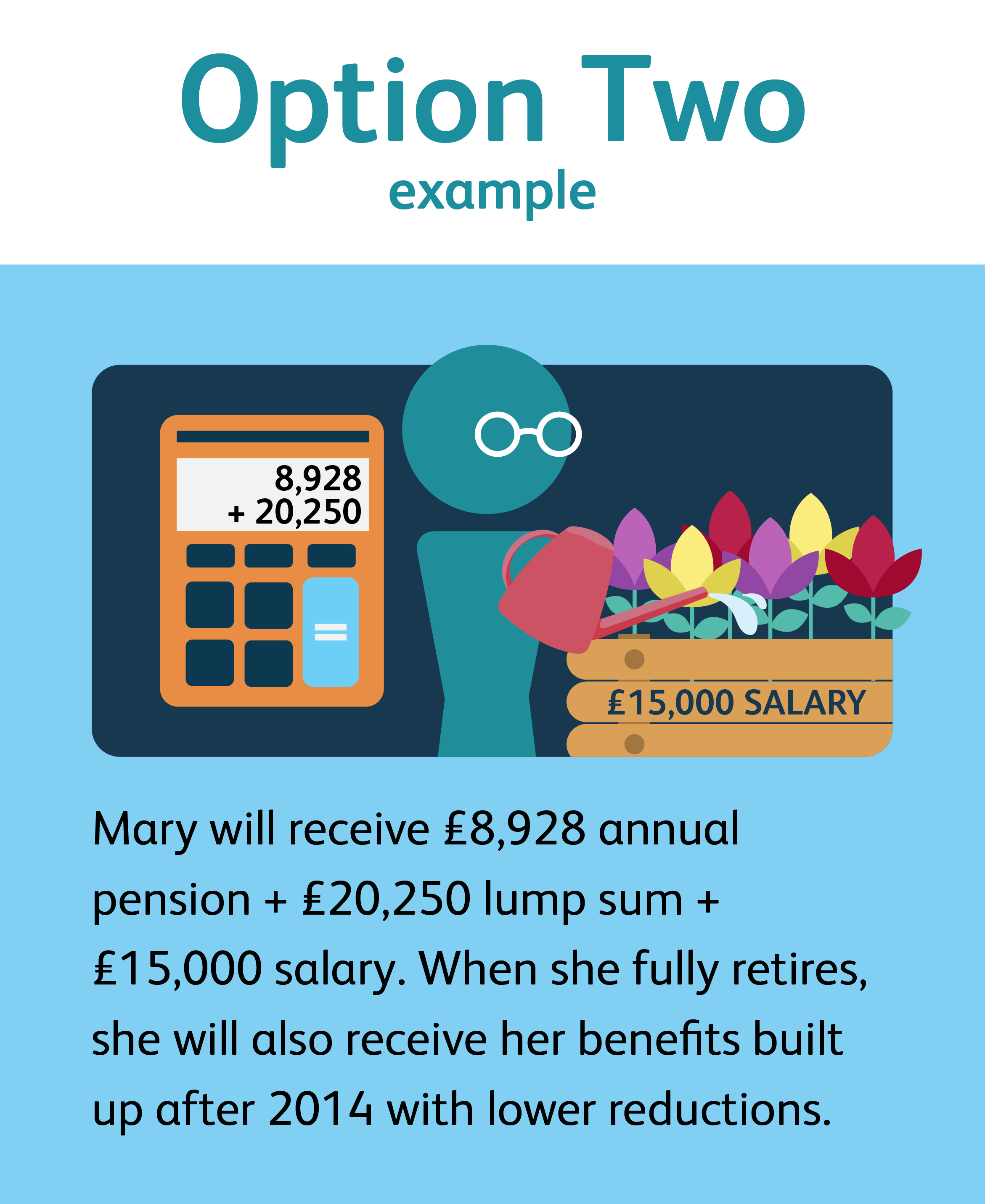

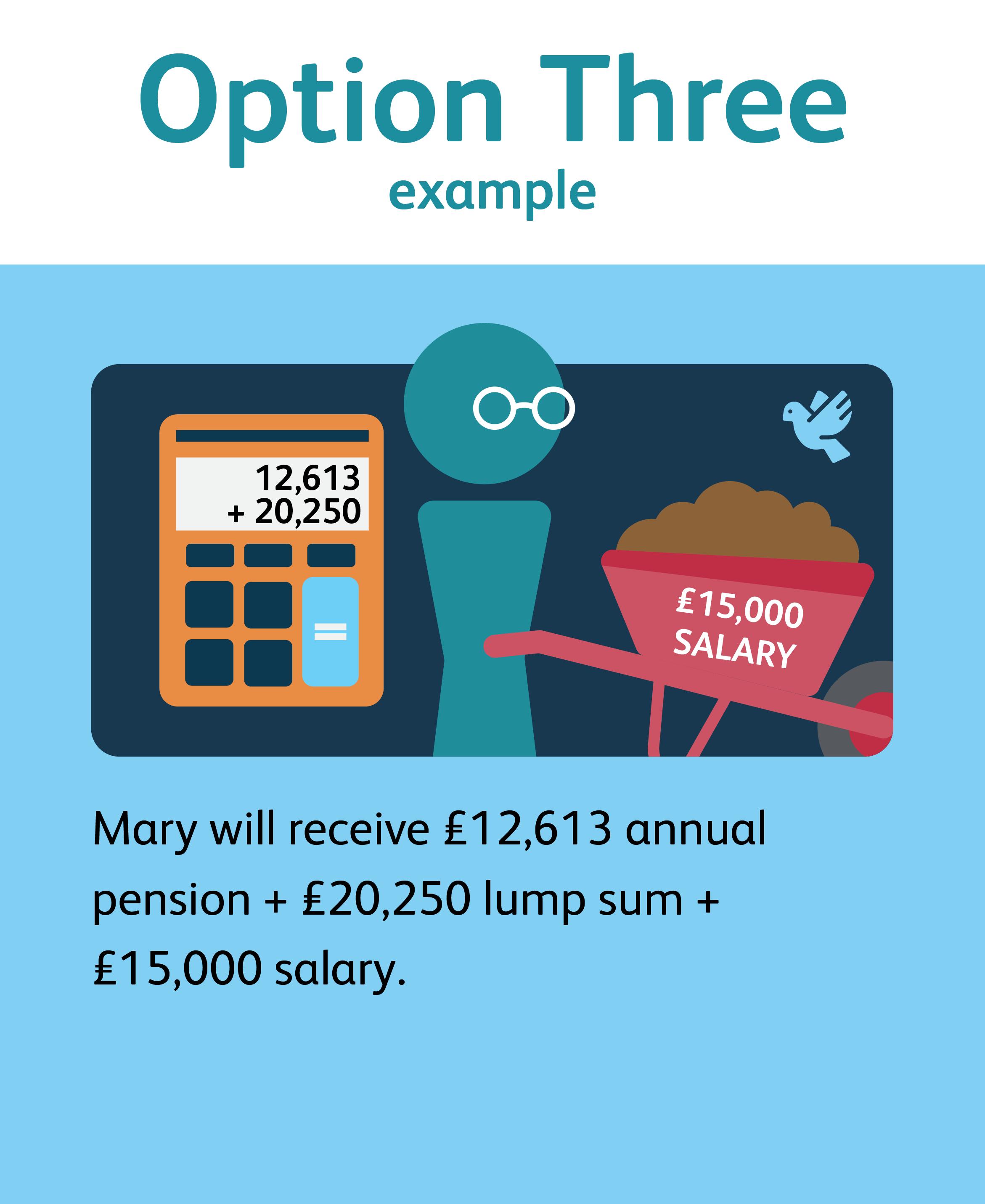

In most cases, you can reduce your hours or move to a less senior role and take some or all of the pension benefits you have built up (which helps to balance any drop in income). You must take all the benefits you have built up before 1 April 2008 (including annual pension and lump sum).

You can only take flexible retirement if:

Please note

The Government has announced that the earliest age you can take your pension will increase from age 55 to 57 from 6 April 2028. This will apply to flexible retirement too.

How does flexible retirement affect my pension?

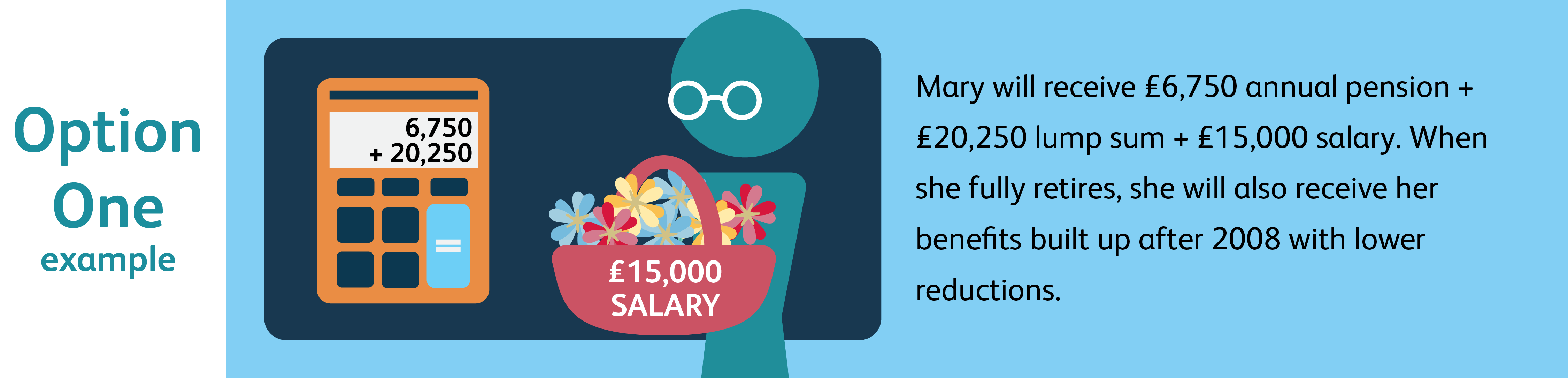

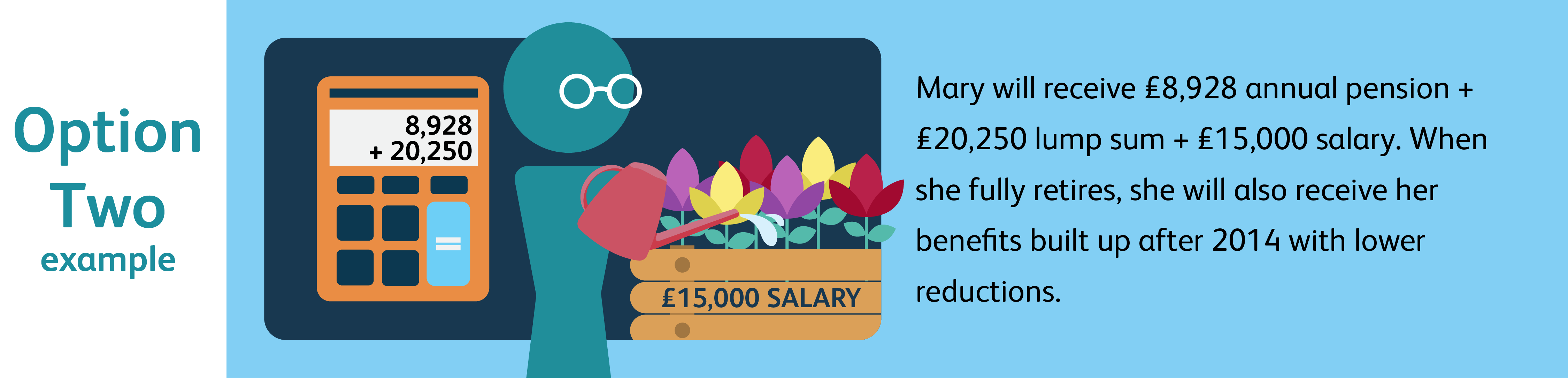

If you take flexible retirement before your Normal Pension Age (NPA), we usually reduce your benefits as we are paying them early. However, your employer can decide not to apply all or some of the reduction. You can ask them for their policy on this.

If you were a member of the LGPS between 1 April 1998 and 30 September 2006, some or all of your benefits could be protected from the reduction under the Rule of 85. Find out more about the Rule of 85 and flexible retirement on the LGPS website.

If you take flexible retirement after your Normal Pension Age (NPA), your benefits will be increased as we are paying them later.

How does it work?

The first thing to do is speak with your employer about their policy on flexible retirement. If your employer agrees, they will notify us and we can begin processing your retirement. Just be aware that your pension is likely to be reduced if you are taking it before Normal Pension Age (NPA) (see above for more details). Learn more about the retirement process.

If you have additional voluntary contributions (AVCs) and your plan started before 13 November 2001, you must use your entire AVC plan when you take flexible retirement.

Important: you are not automatically entitled to flexible retirement. Your employer must agree to it first.

Your employer decides how they apply certain rules relating to your LGPS pension – known as employer discretions. They must have a written policy for these, which you can speak to them about.

Depending on your age, there may also be costs to your employer for paying your benefits early. These are usually higher the further you are from your normal pension age and your employer will need to take any costs into account when considering your request.