UPM employer portal

The guides, videos and FAQs on this page are designed to help you navigate the UPM employer portal and understand how it works.

Contents

Leaver form submissions

To avoid delays in processing retirements, please submit leaver forms on the UPM employer portal at least 30 days before the member’s retirement date. If it helps, you can use an estimate of the final pay figures when completing the form.

UPM employer portal – key updates

Previous

Simpler forms

Simplified the leaver form to make it quicker and easier to complete.

Automated notifications

Started to receive automated email notifications whenever there’s outstanding queries on a data return.

Real-time quotes

Functionality introduced so real-time quotes can be run for redundancy, tier 3 ill health and retirement.

Multiple features

New features included the ability to view all submitted forms, a monthly returns error report, and real time quotes for tier 1 and tier 2 ill health retirement.

New validations

Introduced validations to the reason for leaving section of the monthly return to reduce the need to submit a leaver form.

Reassigning & training

Added the ability to select and reassign multiple items in the Work Feed and reassign them in one go, and a tile to access training material.

UPM employer portal

- You can use the employee’s payroll number when undertaking a member search.

- You can reassign a process that you have started to another employer portal user within your organisation.

- You can ‘filter’ and ‘sort’ via buttons in your work feed.

Coming soon

New leaver form – coming soon

Later this year, LPPA will launch a new and improved leaver form with smarter features to make things easier for you when submitting leaver information. Here’s how…

1. User guide

Download the guide below to get a better understanding of how to use the UPM employer portal.

2. Accessing the UPM employer portal

There are two ways to get access to the UPM employer portal. Open up the most relevant accordion below.

If you are an existing Site Administrator, you are responsible for giving your colleagues within your own organisation access to the employer portal.

To do this, you need to create them as a new user.

1. In the Change My Account section, click on ‘Start a Process’ and under Employer Manager select ‘create a new user’.

2. Search for the employer you want to create as a user.

3. Fill out the user’s account details (Fig. 3) and click submit.

4. You will then be taken to a page to authorise the new user account you’ve created (Fig. 4). Check the details and click submit.

5. You should now receive an email, which includes the new user’s activation code for them to activate their account.

This code is only valid for three days. An email will also be sent to the user, which includes their username and a link to the portal where they can enter their activation code and set up their log in details. Please note, as a security measure, the user will be told to contact you to provide them with their activation code.

Please note

You cannot add a new user if you don’t have Site Administrator access (see the Access to the employer portal section for details).

If you are an employer without a site admin, you will need to download the Access request form below and send it to us.

3. Data return

4. Running estimates

The guide below will show you how to run real-time quotes for redundancy, tier 1, 2 and 3 ill health and retirement.

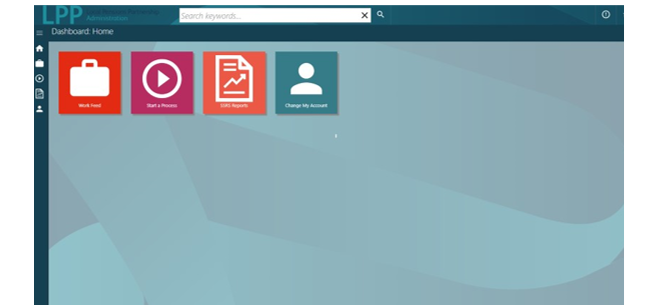

Step 1: On your home page, select Start a process

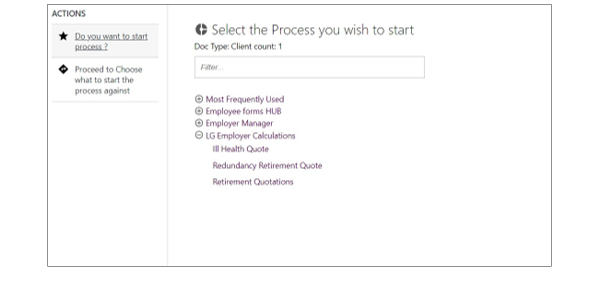

Step 2: Select LG Employer Calculations and then select 1 of the 3 estimate options

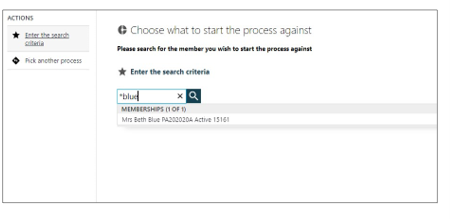

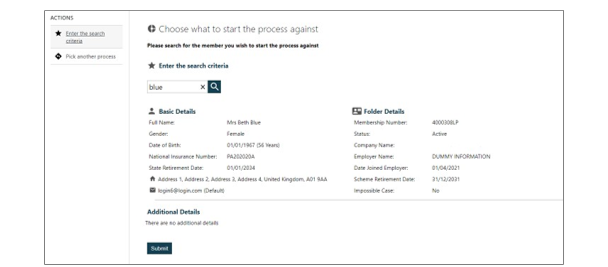

Step 3: Search for the relevant member by name, folder reference or National Insurance number as per the example below (which is a dummy record for illustration purposes).

Please note: you can search using part of a name if you include an asterisk (*) on either side of your search. For example *Name*. This search would highlight all members under the employer with that name.

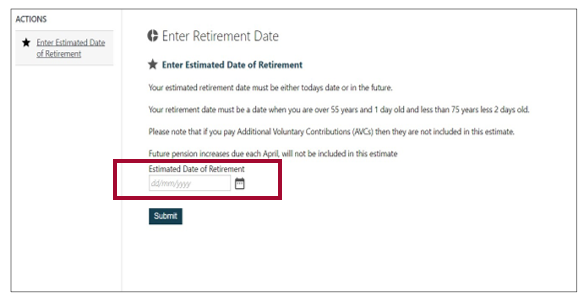

Step 4: Enter the estimated date of retirement

The member’s details will be displayed and then press submit

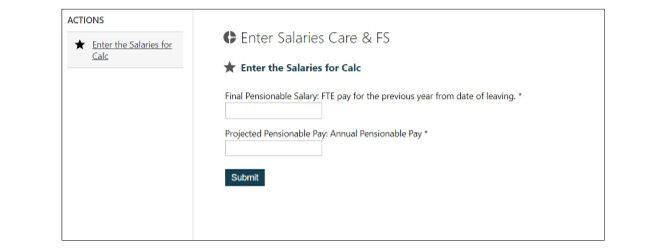

Step 5: Enter the CARE and Final Salary figures

Please note: the Final Pensionable Salary is the full time equivalent estimated pay for the 365 days prior to the last day of service. Projected Pensionable Pay is the estimated annual CARE pay (it is the actual pay and should not be scaled up if the member is part time).

If the member does not have any final salary pension, you may not be asked for this figure.

The projected Pensionable Pay: Annual Pensionable Pay figure is the projected CARE pay for the period 01 April to 31 March.

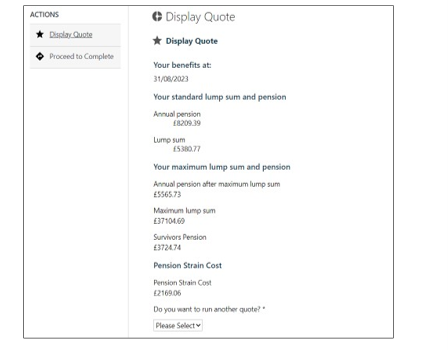

Step 6: Select display quote to see the estimated benefits.

Please note: the process is exactly the same for all 3 estimate options. If you select yes on run another quote, the document will not be saved to the member file. All ill health estimates are based on tier 3 benefits.

What is strain cost?

Pension strain costs occur when there is a clear shortfall in the assumed level of funding needed to provide a particular pension benefit. Often, strain costs occur when a member draws their benefits earlier than expected.

Step 7: If you would like to download a copy of the estimate, search for the member and the estimate will be there to view under documents.

5. Updating employer contacts

The step-by-step guide below shows you how to update your employer contacts via the UPM employer portal.

Step 1: Log in to UPM with your username and password.

Step 2: To first obtain details of all contacts you will need to run a report. To do this, click on the SSRS Reports link to view employer contacts.

This will provide you with a list of employer contacts, which will be displayed, along with their unique contact numbers. You will need to know this unique contact number to amend and delete contacts.

Step 3: Click on the Employer – View Contact Details Report link.

Select the employer from the dropdown list.

Then click View Report.

Follow the steps below to add, amend, and delete contacts.

Step 4: Click on the Start a Process link.

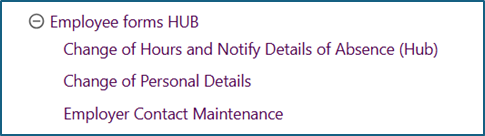

Step 5: Under menu item Employee forms HUB, select Employer Contact Maintenance.

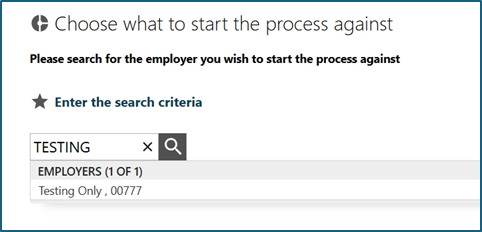

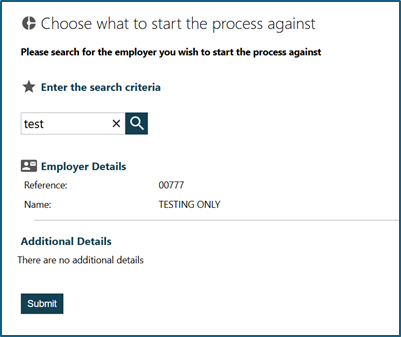

Step 6: Enter the employer’s name that you wish to create or amend a contact for.

Step 7: Click Submit.

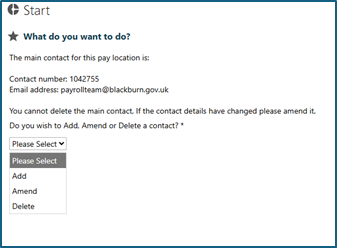

Step 8: Select the action you wish to take from the drop-down menu. You have three options: Add, Amend, and Delete.

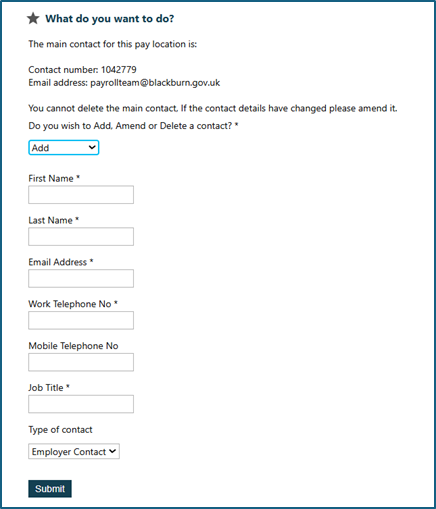

Step 9: To add a new contact, complete the form with the contact’s details and select the contact type from the drop-down menu.

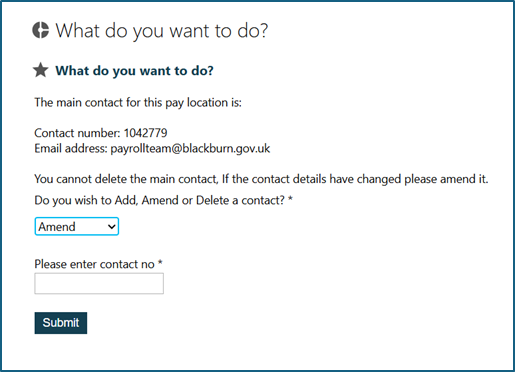

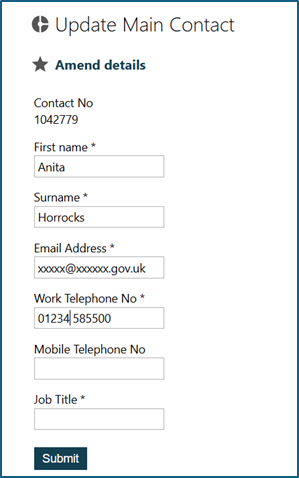

Step 10: To amend a contact, complete the relevant steps above and select Amend from the drop-down menu. Then enter the contact’s unique contact number.

Step 11: Update the fields you wish to change and click Submit.

Step 12: To delete a contact, select Delete from the drop-down menu and select the option to confirm deletion.

Please note: if you wish to delete a main contact, you will first need to update another person as the main contact by selecting the Amend option. This is because there must always be a main contact applied to each employer.

Navigation questions

Once you have been transferred over to the UPM employer portal, you will receive an email within a few days, giving you access to the site.

If you are new to your organisation, please speak to your site administrator who will be able to add you as a user.

You’ll only need one set of login details to access different employers, as long as they are in the same pension fund.

If you need to access an employer in another pension fund, please let us know by completing an Employer Contact form. We can then ask a site administrator to provide you with additional login details for that fund.

Yes, you can, but only if it is a leaver form (at the moment). We are looking to introduce this feature to other forms in the future.

If you’re a Site Administrator, you can add new users and change their level of access. See the User Guide for more information. To delete a user, please contact LPPA using the Employer Contact form.

Yes, you can. To view a form that’s been submitted:

- Search for the member in question using the search keywords bar.

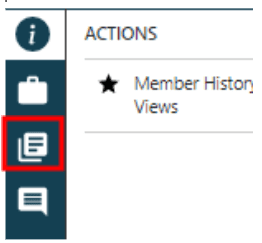

- Once selected, click on the ‘documents’ icon in the left-hand panel (see highlighted below).

- The leaver form you want to view will then be listed within the documents.

7. Understanding the joiner and leaver processes

Common joiner questions

Providing information on new joiners in bulk is not yet available on the portal. Once we’ve introduced monthly data returns, following the 2021/22 End of Year file submissions, the system will be able to provide details of all joiners and changes within one data upload submission.

Common leaver questions

No. If you partially complete a form, it will simply remain on the workfeed until you hit the submit button. But you will not receive any prompts to say that this is incomplete.

No, the workfeed can’t be exported to Excel. From the Workfeed page you can open an item in a separate tab, or select an item and reassign it to a different user.

Yes. You will need to complete a leaver form for every position a member holds.

Assumed pensionable pay (APP)

Assumed Pensionable Pay (APP) is determined by a member’s individual pay and must be adjusted if an employee is absent from work for a period that crosses 31 March for two consecutive years.

The amount must be adjusted to start from 1 April each year (specified in the annual Public Service Pensions Revaluation Order).

Carer’s leave

New carer’s leave regulations (taking effect from 6 April 2024) entitle employees to take up to a week’s unpaid leave in a 12-month period to provide or arrange care for a dependant. They must either:

- Have a physical or mental illness

- Have a disability

- Need care because of old age

There is no statutory right to pay during carer’s leave. It will be treated as other periods of authorised unpaid leave, under LGPS regulations.

This means the member will have the option to buy back any lost pension using an APC, with the cost being shared with the employer if they choose to do this within 30 days. If an employer chooses to pay the member, their pension will continue to build up as normal.

The Firefighters’ Pension Scheme regulations have also been amended. The updated regulations mean unpaid carer’s leave counts as pensionable service, and pension contributions will be deducted from any carer’s leave payments.