Ill health retirement (Firefighters)

If you’re a member of the Firefighters’ Pension Scheme and unable to work because of ill health, you may be able to retire early regardless of your age.

Contents

Do I qualify?

If you have not reached your Normal Pension Age (age 60) and are permanently unable to work because of ill health, you may qualify for ill health retirement.

Types of ill health pension

There are two types (or ‘tiers’) of ill health pension – lower and higher tier.

The tiers are based on your length of service and how capable you are of working before your Normal Pension Age. The tier you’re awarded will determine how much pension you get.

Your employer ultimately decides which tier you qualify for, as long as you meet the criteria below. But before they decide, they must get the opinion of an Independent Qualified Medical Practitioner (IQMP). See more details in the next section.

| Lower tier | Higher tier | |

| Qualifying service | Minimum three months | Minimum five years |

| Ability to work | Incapable of doing any duties of your role until Normal Pension Age | Incapable of taking on regular employment until Normal Pension Age |

| Conditions | Must be entitled to a lower tier ill health pension. |

Regular employment

This is paid work for at least 30 hours a week for one year.

What will the medical practitioner do?

Because your employer is not a medical expert, they must get the opinion of an Independent Qualified Medical Practitioner (IQMP) before they decide if you qualify for ill-health retirement.

Independent Qualified Medical Practitioner (IQMP)

An IQMP is an approved doctor or consultant who is qualified to give their medical opinion on your pension case

The IQMP will assess if you:

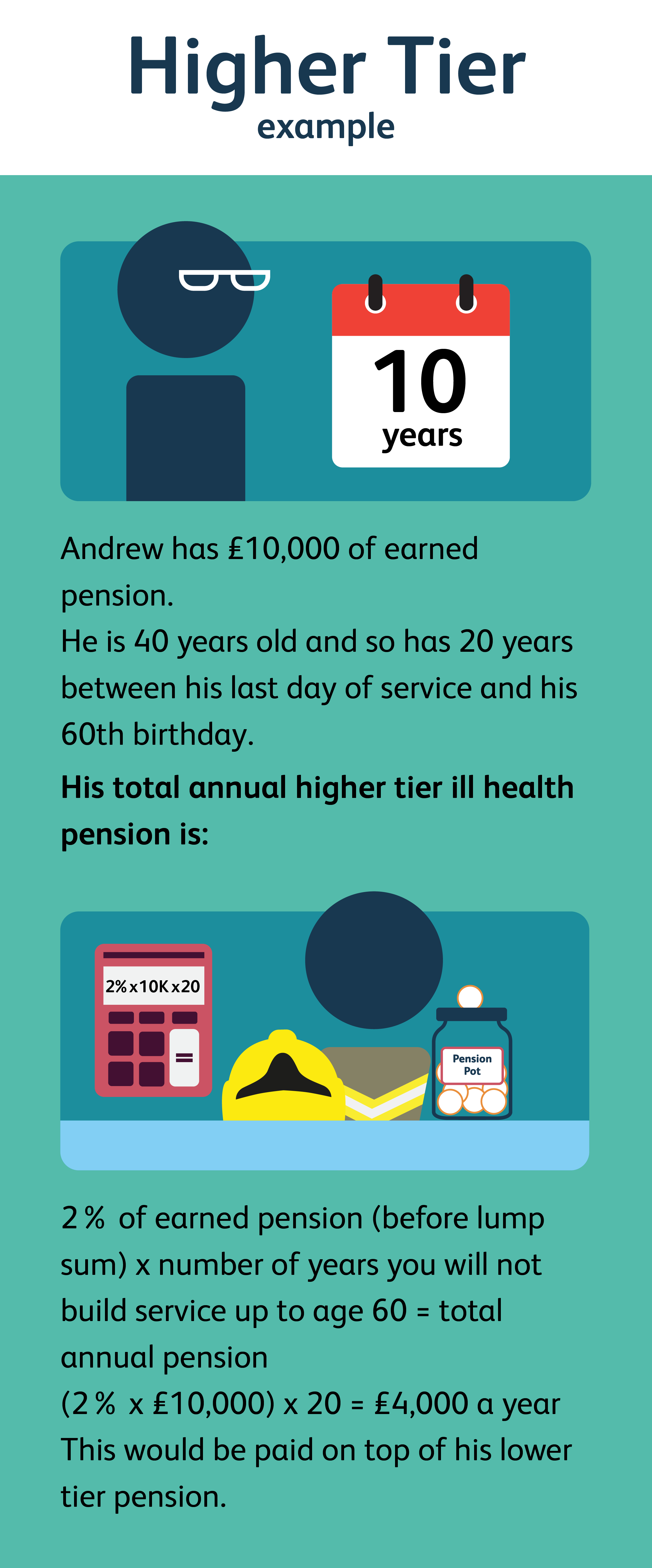

How is my pension calculated?

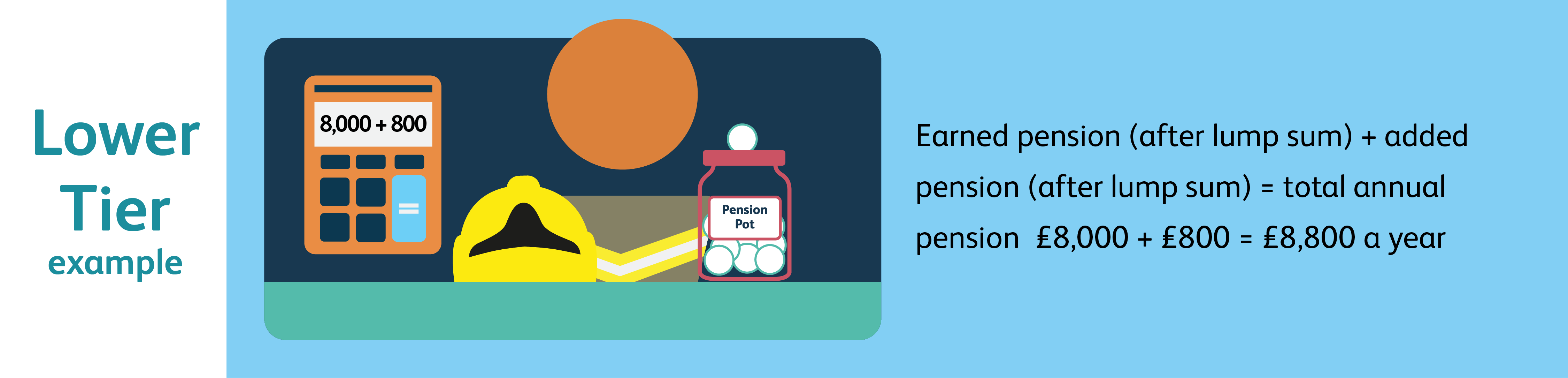

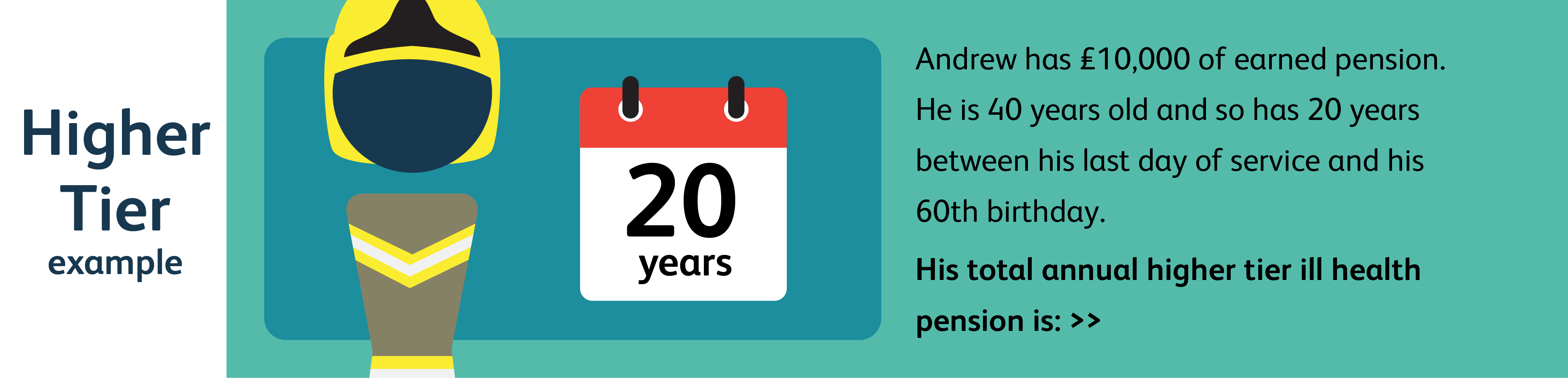

Working out your annual pension income depends on the tier you qualify for, as both are calculated differently.

Please note

You can’t swap part of a higher tier pension for a tax-free cash lump sum (you can only swap part of your lower tier ill health pension).

If you previously paid into the 1992 or 2006 Firefighters’ scheme and qualify for ill health retirement under the 2015 scheme rules, your pension will include ‘an equivalent amount’. This amount is the ill health pension you would have been entitled to from your old scheme, based on the service you had built up before moving to the 2015 scheme.

Will my benefits be reviewed?

If you have been receiving an ill health pension for less than 10 years and have not reached State Pension Age (age 66), your fire and rescue authority (FRA) must review your health to check if you’re still entitled to the pension.

Your FRA chooses how often to do these checks and will get a medical opinion from an IQMP, before deciding if your ill health payment should continue.

Your FRA must consider if you’re now fit enough to take on regular employment.

If you are fit enough, your higher tier pension will stop but your lower tier pension may continue to be paid (see section below).

Your FRA must consider if you’re now fit enough to do the duties of the last role you were employed in when you retired due to ill health. If you are not fit enough, your lower tier pension will continue to be paid to you.

If you are fit enough, your FRA will consider rehiring you for the same job role you retired from. Whether or not your pension continues depends on their decision to give you a job offer:

- If your FRA makes an offer and you accept it – your lower tier pension will stop.

- If your FRA makes an offer but you refuse it – your lower tier pension will stop and your FRA will set up a deferred pension account for you. In this account, they will put in the same amount of annual lower tier pension you received before it stopped. The deferred pension would be paid to you at deferred pension age (age 66).

- If your FRA does not make an offer – your lower tier pension will continue to be paid to you.

Unfortunately, under the scheme rules, it is not possible to move up to a higher tier pension if your health deteriorates. Your ill health pension can only be reviewed ‘downwards’ – from higher tier to lower tier or stop all together (as explained above).

Ill health retirement and deferred pensions

If you have a deferred Firefighters’ pension and have not reached deferred pension age (age 66), it may be possible to take out your deferred pension early as a result of ill health.

To qualify, you must be incapable of taking on regular employment (paid work for at least 30 hours a week for one year) at least until deferred pension age.

Your fire and rescue authority (FRA) will decide if you qualify, after considering the opinion of an Independent Qualified Medical Practitioner (approved doctor or consultant).

Extra benefits

You may be eligible to swap part of your deferred pension for a tax-free cash lump sum.

You can also nominate a beneficiary in your online PensionPoint account to choose who you would like to receive your death grant in the event of your death.

Review

Your FRA will keep your ill health retirement under review until deferred pension age, to check if you’re still entitled to it and whether your health has improved.

If you become capable of taking on regular employment, your payments will stop. Your pension will be suspended and remain in your account until you reach deferred pension age.