Ill health retirement (LGPS)

If you’re unable to work due to ill health, you may be able to take your LGPS benefits early regardless of your age.

Contents

Do I qualify?

If you’re actively paying into the LGPS, you must meet the following criteria to qualify for an ill health pension:

Gainful employment

This is paid work for at least 30 hours a week for one year.

Types of ill health pension

There are three types of ill health pension (known as ‘tiers’).

These are based on how likely it is that you could carry out gainful employment before your Normal Pension Age (NPA) in any job. The tier you’re awarded will determine what pension benefits you’ll get and how long for.

Your employer ultimately decides which tier you qualify for, as long as you meet the three initial criteria explained above and all the criteria for a particular tier. But before they decide, your employer must get the opinion of an Independent Registered Medical Practitioner (IRMP).

| Criteria | Tier 1 | Tier 2 | Tier 3 |

| Qualifying service (vesting period) | Minimum two years | Minimum two years | Minimum two years |

| Ability to work | Unable to do duties of your current job | Unable to do duties of your current job | Unable to do duties of your current job |

| Gainful employment | 1 Not immediately capable of gainful employment 2 Unlikely to manage gainful employment before your NPA | 1 Not immediately capable of gainful employment 2 Unlikely to manage gainful employment for at least three years but likely able to before your NPA | 1 Not immediately capable of gainful employment 2 Likely to manage gainful employment within three years or before your NPA (if earlier) |

Please note

If you’re dismissed from work on health grounds, it doesn’t mean you’re automatically eligible for an ill health pension. You will still need to satisfy all the criteria outlined above.

| Benefits | Tier 1 | Tier 2 | Tier 3 |

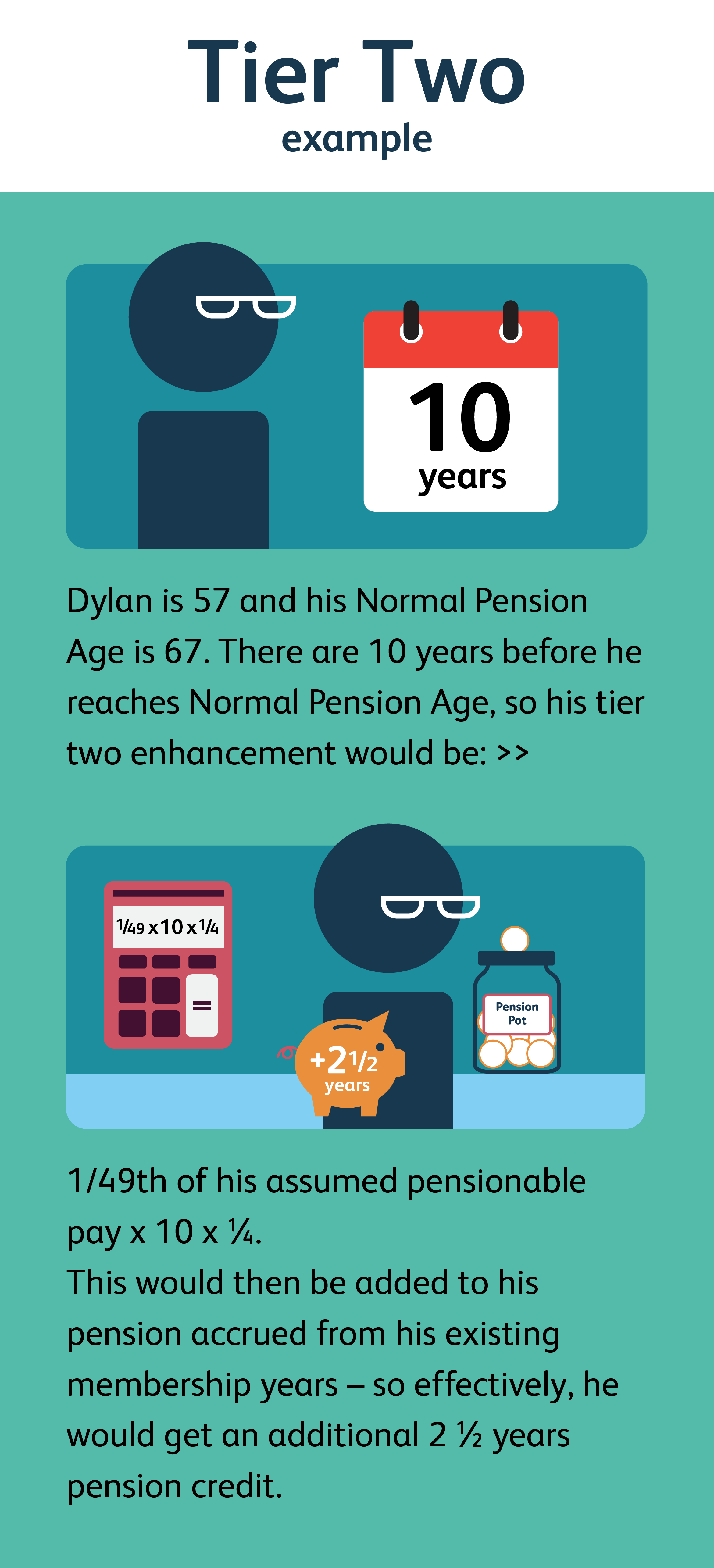

| Pension that will be paid to you | – The pension you have already built up on your date of leaving. – Plus, the additional pension you would have built up in the main section of the LGPS if you had continued working up until your normal pension age (NPA). | – The pension you have already built up on your date of leaving. – Plus, 25% of the pension you would have built up in the main section of the LGPS if you had continued working up until your normal pension age (NPA). | The pension you have already built up on your date of leaving. |

| Reduction for early payment | No reduction | No reduction | No reduction |

| How long are you paid for? | Paid for the rest of your life | Paid for the rest of your life | Paid temporarily up to three years but may stop earlier based on a review |

| Will my benefits be reviewed? | No | No | Yes |

What will the medical practitioner do?

Independent Registered Medical Practitioner (IRMP)

An IRMP is a health professional approved to carry out medical assessments for pension purposes.

Because your employer is not a medical expert, they must get the opinion of an IRMP to assess you, before they decide if you qualify for ill-health retirement.

In their assessment, the IRMP will use information given by your GP, consultants and employer. Usually, you won’t need to meet with the IRMP. But sometimes, they may ask to speak to you directly, either in person or over the phone. If you would prefer to see them in person, you can request this through your employer (although this is not always possible).

If you provide detailed information and give consent for your GP/consultant to share your medical records, you may not need a face-to-face assessment. You can say no to giving consent but it’s unlikely the IRMP will have enough information to assess you.

A typical assessment can take between 4-12 weeks, depending on your individual circumstances. Once the IRMP completes your assessment, they will pass on a medical certificate to your employer, confirming whether you meet the ill health retirement criteria. They will also give an opinion on which tier reflects your situation.

A Tier 3 pension can only be paid for a maximum of three years. After 18 months of receiving a Tier 3 pension, your employer will carry out a review. They might also carry out another one after three years. For the review, an IRMP will do a medical assessment to see if you can carry out gainful employment.

They will then recommend one of the following decisions to your employer:

- You no longer qualify for ill health retirement and your Tier 3 pension will stop immediately.

- You still qualify for Tier 3 and your pension will continue to be paid to you for the rest of the three years.

- You now meet the qualifying criteria for a Tier 2 pension and you will be moved up (‘uplifted’) to Tier 2 from the date your employer made the decision.

For more details on each tier, visit the LGPS website below.

How are my benefits calculated?

Working out your pension benefits depends on when you joined, how many years you’ve been an LGPS member and your final salary when you retire.

For each year of membership up to 31 March 2008, you will receive an annual retirement income, which is 1/80th of your final salary. Plus a one-off tax-free lump sum, which is three times your pension.

- Annual retirement income = final salary x membership years / 80

- Tax-free lump sum = final salary x membership years / 80 x 3

If you were employed part time, we pro rata the equivalent full-time pay. But if you have been working reduced hours due to ill health, your benefits would be based on you working full time.

For each year of membership from 1 April 2008 – 31 March 2014, you will receive an annual retirement income, which is 1/60th of your final salary.

- Annual retirement income = final salary x membership years / 60

- No automatic tax-free lump sum

If you were employed part time, we pro rata the equivalent full-time pay. But if you have been working reduced hours due to ill health, your benefits would be based on you working full time.

For each year of membership from 1 April 2014, you will receive an annual retirement income, which is 1/49th of your career average pay.

- Annual retirement income = career average pay / 49

- No automatic tax-free lump sum

Important to note if you’re retiring on Tier 1 or Tier 2

In some cases, your ill health pension will be calculated differently. If you have previously received an ill health pension and retire again due to ill health, your pension may not be increased or may be capped. Visit the LGPS website for more details on the rules covering these special cases.

Tier 3 benefits

These are calculated based on your current pension pot (without any ill health enhancements).

They are payable for up to three years but may be stopped if you start a new job or the IRMP decides you’re capable of working following your 18-month review. Once your Tier 3 pension has stopped, it will normally become payable again from age 55 onwards.

Just remember, if you take it before your Normal Pension Age, your pension will be reduced.

Ill health retirement and deferred pensions

You don’t have to be an active member of a pension scheme to claim your pension on ill health grounds. If you’ve left employment and have a deferred LGPS pension, you can still apply for your benefits to be paid early due to ill health.

Unlike retirement from active employment, there is no three-tier system for ill health and no enhancement benefit would be paid to you if you took your deferred pension early due to ill health. However, your pension would not be reduced in the same way that it would if you chose to voluntarily take out your benefits before your Normal Pension Age.

Your former employer must get an opinion from an independent health practitioner stating that:

- Because of your health, you would be permanently incapable of the job you were working in when you left the LGPS.

- If you left the LGPS after 31 March 2008, you must also be unlikely to be capable of taking on any gainful employment within three years of applying for ill health or by your Normal Pension Age (whichever is earlier).

To apply for ill health retirement, you need to contact us first

Contact LPPA

Send us a letter or email explaining why you want to apply for ill health retirement. In your email, include full dates of your employment and as much supporting evidence as you can (all medical forms will always be returned).

Sending your request

We contact your former employer and pass on your request.

Medical assessment

Your former employer refers you for a medical appointment to assess your case. They use the medical practitioner’s report from this appointment to approve or decline your request.

Confirmation letter

You receive confirmation in writing. If your application is approved, you are sent the forms you need to access your pension. If it’s declined, you are given an explanation of the decision, along with details of how you can appeal.

Benefits released

Once you’ve completed the paperwork and we’ve received it, any eligible pension benefits are paid to you. You may also be given the option of swapping some of your annual retirement income for a tax-free lump sum.